Investors

We are the leading experts in global identity and location

On this page, you can access our latest investor news and resources

In an increasingly digital world, we help businesses grow by giving them intelligence to make the best decisions about their customers, when it matters most.

Every second, our global data, agile technology, and expert teams, power over 20,000 of the world’s best-known organisations to reach and trust their customers.

Our investment case

Building trust for business and driving long-term profitable growth for investors.

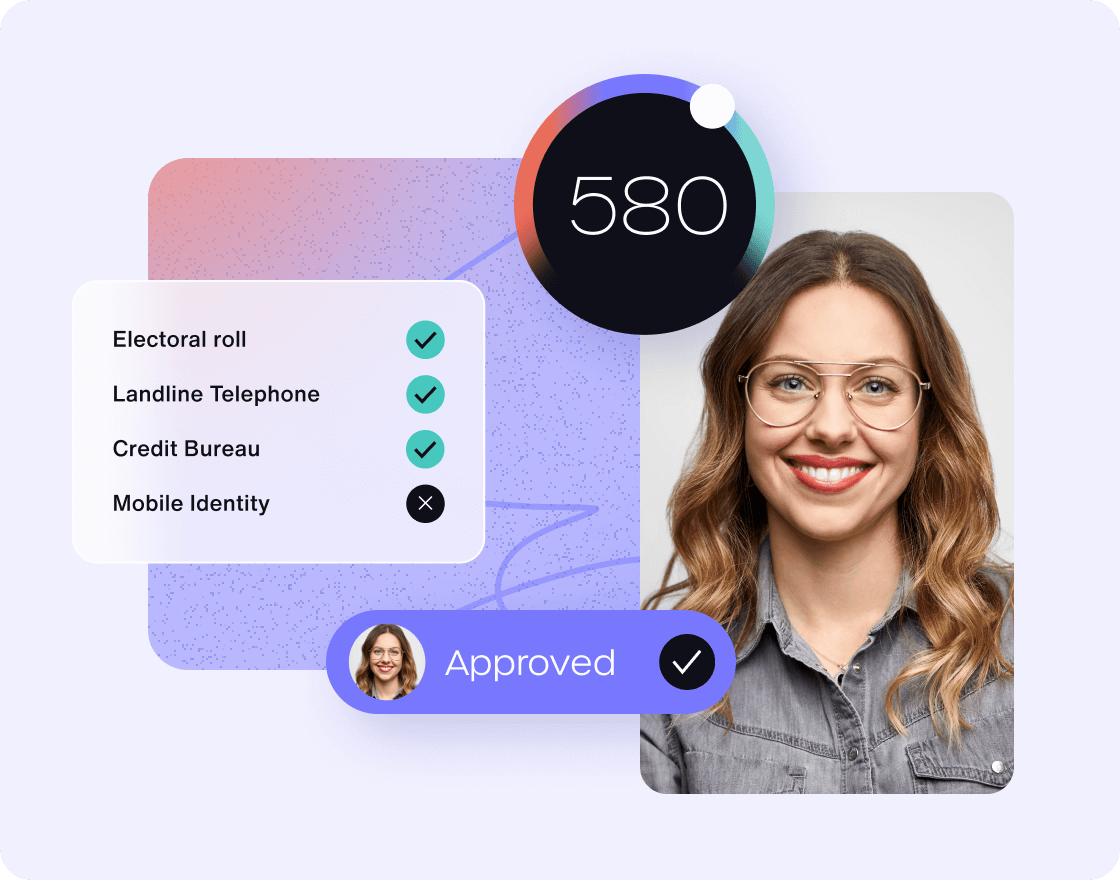

Our agile technology and worldwide data coverage are built on a deep understanding of global identity and location information, their lineage, structure and local nuances. This has enabled us to build secure and trusted technology which interprets information at a highly granular level to provide immediate identity and location intelligence.

Differentiated offering

Global data coverage, best-in-class technologies and local expertise.

Our unrivalled service is built on the deep global identity and location market expertise of our people. Our highly engaged team of market experts collaborate and build trusted relationships with our customers, delivering insights that enable their critical decisions and enhancing our business performance.

Expertise

Market experts with trusted relationships underpin our success

We are a trusted adviser and growth partner to our customers globally at scale and across a diverse range of sectors. Our unique identity and location intelligence provide insights that drive critical decisions. Today, we ensure over 20,000 organisations can reach and trust their customers in more than 70 countries worldwide, from the biggest banks and eCommerce giants to the best-known household brands.

Geographic and sector reach

Partnering at scale and across sectors

Our relevance in an increasingly digital world means we are well positioned to execute on the opportunities within fast-growing markets. Enduring growth is being driven by structural trends such as the digital transformation, a dynamic regulatory context and the growth in eCommerce, fraud and financial crime. Our solutions balance consumer demand for frictionless experience with our customer’s needs for security and compliance.

Growing market opportunity

Structural growth in our markets increases our relevance

Our attractive financial model is driven by ~95% repeatable revenue consisting of transaction and subscription activity which drives profitable and cash-generative growth. Underpinned by our strong balance sheet, this enables disciplined capital allocation for the benefit of all stakeholders including ongoing investment in our market-leading solutions and a progressive dividend policy.

Financial strength

An attractive cash-generative financial model

Key information

Sustainability

Learn how our ESG Strategy embeds a sustainable and ethical approach to environment and everyone in everything we do.

RNS releases

Financial calendar

-

GBG Financial Year-end

- 31 March 2025

-

FY25 trading update

- 24 April 2025

-

FY24 Results published

- Mid-June 2025

-

Annual general meeting

- Mid/Late July

Get in touch with Investor Relations