The customer

Currencies Direct is an award-winning foreign exchange and currency transfer company offering simple, fast and secure international money transfers.

The challenge

Currencies Direct was looking to optimise customer identity verification at onboarding and improve the experience for customers accessing their international money transfer services via their mobile app and website. As a regulated financial services provider, the company takes security and the threat of fraud seriously and, with a growing customer base and an expanding portfolio of products, it wanted to increase fraud protection without adding unnecessary friction for new customers creating accounts.

The solution

The Mobile Intelligence test

Currencies Direct launched a live trial of GBG Mobile Intelligence, by simply adding mobile ID data to their existing identity verification checks using GBG ID3global. The team wanted to test whether matching prospective Currencies Direct customers to their mobile devices could provide an extra layer of identity authentication, reducing the risk of identity fraud, without creating any unnecessary barriers in their customer onboarding process.

The test of over 3000 customers immediately produced some interesting results, including, an increase in automatic customer onboarding, a reduction in manual reviews and blocking real-time fraud attacks.

Key results

- 5% increase in automatic acceptance at customer onboarding

- 74% Mobile-to-Person (MPM)™ match authenticating customer identity data

- Flagged a high-risk SIM swap preventing £25,000 in fraud losses

"We wanted a seamless and passive way to verify our customers while also detecting real-time fraud attacks.”

Ibrahim Nazirudeen, Head of Product Risk & Compliance

Currencies Direct

Mobile-to-Person match

GBG Mobile Intelligence includes a Mobile-to-Person (MPM)™ service to match a prospective customer’s name, address, postcode and date of birth to the live information held by their mobile operator. The data is hashed in real time prior to matching so no personal identifiable information (PII) is shared without the customer’s consent.

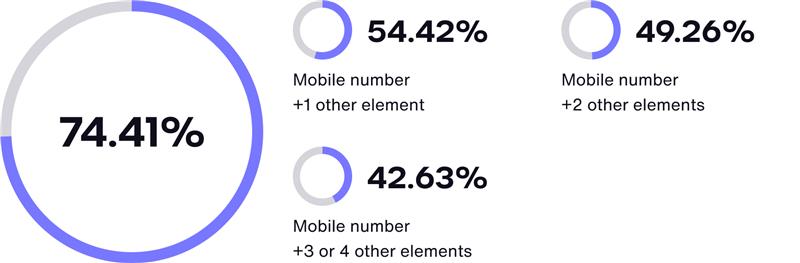

In this live test, the Currencies Direct team were able to authenticate 74% of customer data. 53% matched on mobile number and at least one other data element, 49.3% matched on two data elements, and 42.6% matched on three or four data elements.

Mobile-to-person match (MPM)

The MPM analysis also provided Currencies Direct with data on the mobile account type. This data can be used to flag potential fraud signals, if for example, the account has been created without independent identity verification by a mobile operator and is a less trustworthy means of identity authentication, such as Pay As You Go mobile.

By swiftly and silently validating the digital identity data elements presented by a prospective customer with a Mobile-to-Person match, the Currencies Direct team can protect against synthetic identity and application fraud. The team were able to increase automated onboarding decisions by 4.5% and, with increased confidence in the customer contact data they hold, offer a better in-life customer experience.

Mobile fraud signals

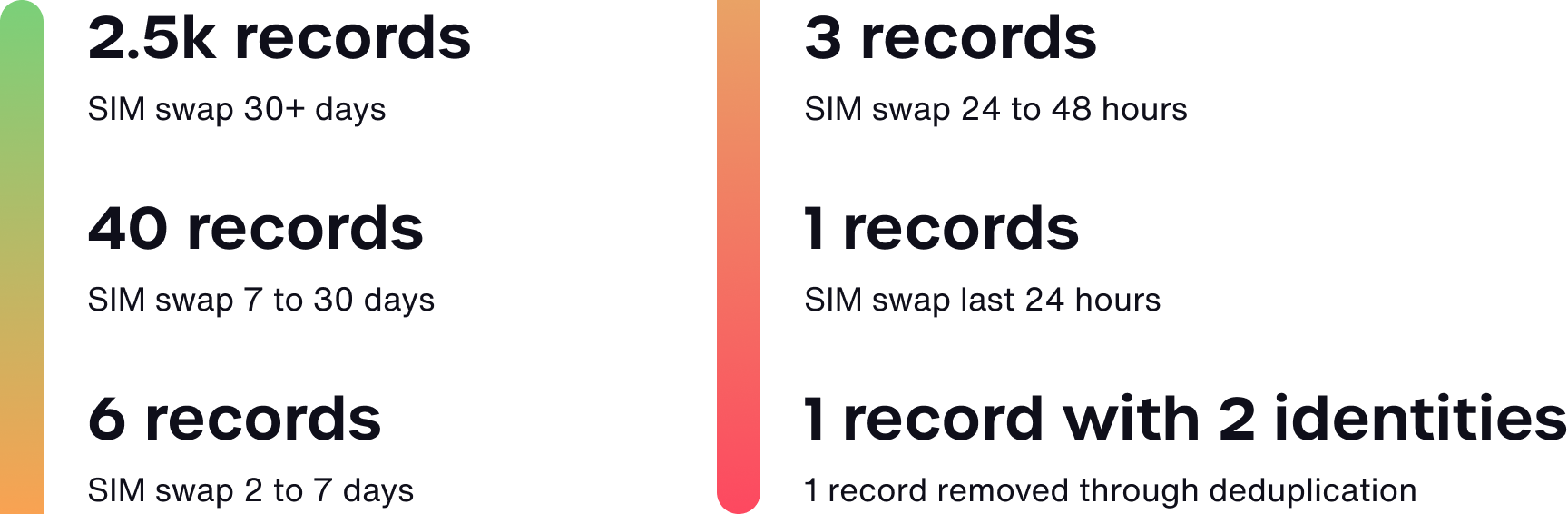

The Currencies Direct live trial also provided a clear demonstration of the value of the SIM Swap and Call Forwarding Detection features of GBG Mobile Intelligence. Mobile SIM swapping and the direction of calls to another number are both potential fraud signals, indicating account takeover or social engineering.

Based on live data provided by the mobile operator, SIM Swap Detection returns a timestamp showing the date and time of when the IMSI (the unique number attached to each SIM card) was last changed. Call Forwarding checks confirm the live call forwarding status of a unique mobile number (MSISDN) with the mobile operator. Mobile Intelligence converts this data into time-stamped fraud ‘traffic signals’ indicating the level of risk (red, amber or green).

Mobile fraud signals

In this live test, the Currencies Direct team were alerted to four SIM cards which had been swapped within 48 hours. Two records were flagged as ‘highly suspicious’. These had been entered only one second apart, both registering the same mobile number, which was set to Call Forwarding. The Mobile-to-Person match data - address, surname and date of birth - indicated a husband-and-wife team. A third individual was identified following investigation of the 24-hour SIM Swap signal, revealing the use of forged identity documents and stolen debit card details, which helped prevent a fraudulent £25,000 money transfer.

The outcome

Following a review of the live trial, the Currencies Direct team have decided to add GBG Mobile Intelligence to their new card offering, streamlining the customer onboarding process and helping to stop fraud.

“Adding GBG Mobile Intelligence to Currencies Direct onboarding process has helped authenticate users, increase customer match rates and stop application fraud in real-time.”

Ibrahim Nazirudeen, Head of Product Risk & Compliance at Currencies Direct.

Start building trust today

- Verify

- Prove

- Protect

- Investigate