iGaming and KYC in Brazil

Brazil’s gambling industry has long attracted foreign players. The legendary Brazilian casinos of the 1930s and 40s welcomed famous international guests, including, Albert Einstein, Frank Sinatra and Walt Disney.

That heyday ended in 1946 when President Eurico Gaspar Dutra placed a blanket ban on gambling in Brazil. Years later, the Brazilian Senate set the stage for a new influx of international arrivals – this time iGaming operators. In 2023, it passed a law to establish federal licensing of both sports betting and online casino games.

iGaming LATAM opportunities

The iGaming market in Latin America is as diverse as it is dynamic and has been regulating and growing in recent years. One of the big drivers is the growing availability and affordability of high-speed internet and smartphones, increasing online participation across Central and South America.

There are also ongoing, positive shifts in the regulatory environment. With over 34 countries and union territories, Latin America represents a complex map of jurisdictions. As regulations continue to evolve and markets open up, however, iGaming operators that play by the KYC (know your customer) rules, offering safe and engaging experiences look set to win.

“With a population of over 200 million in a nation of sports and gaming fanatics, Brazil’s newly regulated sports betting and online casino market will be big.”

Gambling and sports betting in Brazil

With a population of over 200 million in a nation of sports and gaming fanatics, Brazil’s newly regulated sports betting and online casino market will be big.

In 2023, seventy-two per cent of international operators we surveyed in iGaming in Latin America planned to expand into the Brazilian market; today, over 100 have already applied for Brazil’s new online betting licence.

Know your player identity verification in Brazil

Gambling regulations in Brazil

Playing by the new rules in Brazil could prove more challenging than anticipated for newly licenced operators.

Banco Central do Brasil Anti-Money Laundering (AML) guidelines apply to all businesses with AML obligations in Brazil. Meanwhile, Brazil’s Ministério da Fazenda has issued multiple regulatory guidelines covering iGaming and sports betting rules. Many operators have been following these updates closely and planning the best approach to Know Your Customer (KYC) compliance at player onboarding in Brazil.

In July 2024, the Finance Ministry's Secretaria de Prêmios e Apostas (SPA) issued an AML ordinance listing the end-to-end KYC requirements operators must satisfy to ensure player protection and prevent financial crime.

Player KYC requirements in Brazil

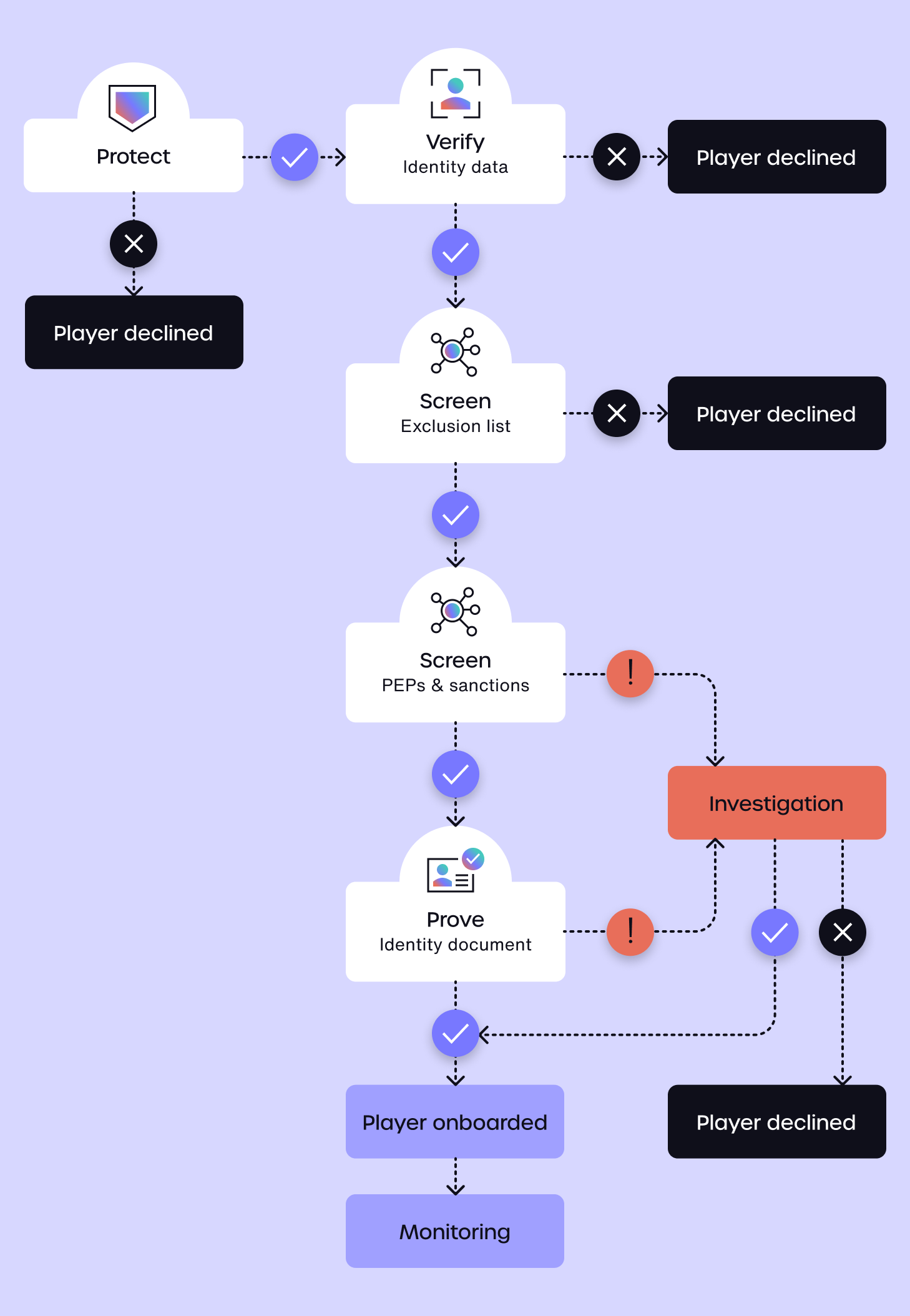

This concise list of player due diligence captures the KYC requirements for operators entering Brazil’s regulated sports betting and online casino market. An account can only be activated once all onboarding checks are complete and passed.

- Age verification (players must be over 18)

- Identity data verification (including CPF number)

- Identity proofing with document and biometrics (face recognition)

- Screening for PEPS, sanctions and players on Brazil’s exclusion list

- Screening for player affordability

End-to-end player KYC in Brazil

To help operators play by these rules, protecting potentially vulnerable players as well as their own business, we’ve outlined the best approach to player KYC as well as fraud and bonus abuse protection in Brazil’s regulated sports betting and iGaming market.

For player onboarding in Brazil, a multi-layered approach to KYC which includes identity data verification, secure identity document proofing and biometric authentication is required.

End-to-end player KYC in Brazil

Complete SPA player verification while protecting your business from identity fraud. Find out how our onboarding intelligence helps operators meet global gaming market regulations, protecting players and your business.

Protect against fraud and bonus abuse in Brazil

Spotting scams and stopping identity fraud right from the start is good practice in Brazil. By adding simple fraud checks to KYC checks, operators can protect against promotion abusers and other bad actors without the need to make further checks.

For example, discrete background checks on an email address when a new player registers for your service offer a rich source of transactional and behavioural history – this email intelligence delivers simple but effective fraud protection.

“GBG Trust brings Tier 1 iGaming operators together across Brazil, Latin America and worldwide to share identity intelligence insights securely.”

Our GBG Trust network brings Tier 1 iGaming operators together across Brazil, Latin America and worldwide to share identity intelligence insights securely and take fraud protection at player onboarding to the next level.

iGaming Latin America market-by-market report on opportunities

While maintaining complete data privacy, GBG Trust detects suspicious identity data anomalies, patterns and high-velocity data submissions and reflects these in a low GBG Trust score. For example, stolen CPF numbers that appear repeatedly in fraudulent applications will produce a low score.

In tests carried out on 100,000 customer identity records by one iGaming business, 88% of low-scoring identities were committing identity fraud or bonus abuse. By setting a GBG Trust threshold these identities can be blocked before onboarding.

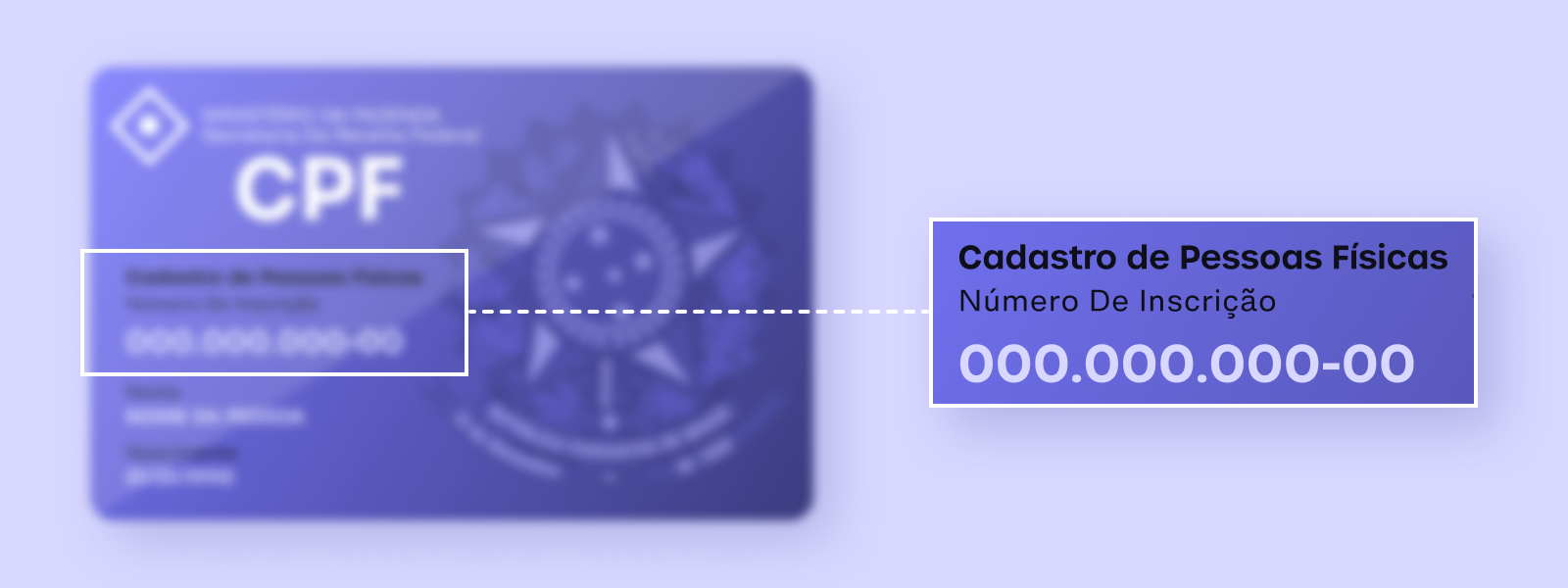

Brazil’s winning number

Whether you’re accessing public Wi-Fi or purchasing football tickets, a CPF number is pretty much essential for life in Brazil. This 11-digit identifier, issued by the Brazilian Inland Revenue Service, proves you have been entered into the Cadastro de Pessoas Físicas (Natural Persons Register) in Brazil.

But be cautious. Like other national ID numbers, the CPF is a top target for identity fraud. At last count, there were more CPF records than residents of Brazil and with over 220 million CPF numbers leaked in cyberattacks, it’s a risky data point to rely on without secure validation.

Verify player identity and age in Brazil

Fast, friction-free identity data checks are the best place to begin KYC in Brazil. Identity and age verification works by matching the personally identifiable information (PII) a prospective player submits at online registration and testing it against reliable, official sources to ensure it is real, verifiable data.

“These trusted data sources, combined with our other identity verification solutions can provide a maximum coverage of ninety-five per cent of Brazil’s population.”

We verify data against up to 24 trusted sources in Brazil, including government records and security systems, credit and mobile data. These trusted data sources, combined with our other identity verification solutions can provide a maximum coverage of ninety-five per cent of Brazil’s population.

Here's our essential list of the player PII operators should elicit in Brazil:

- CPF number

- Full name

- Date of birth

- Address

- Email address

Verifying data against trusted national government sources is a powerful tactic for CPF KYC checks. We verify the status of CPF numbers with Brazil’s Receita Federal or Tax Registry, ensuring the CPF exists and is not a fake number.

There is a highly evolved underground ecosystem facilitating a trade in stolen CPF numbers in Brazil. Operators in Brazil should be aware that these numbers are widely circulated and easily accessible, so it’s important to protect against CPF number fraud as well as verify the data.

Screening and protecting players in Brazil

Licenced operators in Brazil also have a responsibility to screen for high-risk players, people prohibited from holding a gaming account and financially vulnerable players who won’t pass an affordability test.

To correctly follow AML guidelines, operators must run checks for PEPs, sanctioned individuals and identities appearing on Brazil’s player exclusion list. This exclusion list includes operator employees, public servants with responsibility for iGaming and sports betting regulation and anyone who may influence the outcome of sports events such as referees, sports agents, athletes and coaches.

We connect your KYC checks to these lists and affordability data in Brazil, ensuring your players are protected and your business meets its regulatory requirements and responsibility to potentially vulnerable players.

Prove player identity with documents

In other markets, operators can complete KYC at player onboarding with data verification alone. In Brazil, identity proofing with documents and biometric face recognition checks are mandatory to counteract identity data fraud.

Brazil's huge size and federal structure ensure a wide variety of ID documents. Identity documents have even been known to change with political leadership, so proving player identity with ID requires knowledge of the latest document formats. For KYC and player onboarding, there are three main document types accepted:

- Carteira de identidade Nacional bearing (National Identity Card bearing CPF or Registro Geral number)

- Carteira Nacional de Habilitação (CNH) (National Driving Licence)

- Passport

iGaming operators entering the Brazilian market must ensure their identity-proofing technology can pass the toughest street tests. Brazil has many ID documents in varying conditions of age and wear and there’s a wide range of smartphone camera technology, from the latest and greatest to the not-so-great. So, ensure your solution delivers high-quality document capture and accurate identity data extraction.

Document verification and biometric face recognition solutions in Brazil must also be able to spot the signs of counterfeits, fakes and forgeries.

Verify and protect players and your business

Fake IDs are common; crude document printouts are the most frequent kind of Brazilian ID fraud, while sophisticated deepfakes and presentation attacks designed to beat biometric security also occur. Document assessment, tamper detection and liveness testing are all important identity-proofing security features in Brazil.

Know your players in Brazil

As Brazil’s regulated sports betting and iGaming get set to begin in January 2025, the race is on for licenced operators to know the rules and meet the end-to-end KYC requirements of this big new player in the global market.

As the leading global expert in digital identity and go-to partner to 1000s of gaming operators in Latin America and around the world, our trusted technologies are ready to help verify and prove identity, protecting your players and your business with end-to-end player KYC in Brazil.

Download our latest report on iGaming in Latin America.

Frequently Asked Questions

Is online gambling regulated in Brazil?

Yes. Brazil’s newly regulated sports betting and iGaming industry will come into force in January 2025. Regulations require all domestic and international operators to be licenced and to carry out customer due diligence (KYC)

How is online gambling regulated in Brazil?

Brazil’s online gambling market is regulated by the Ministry of Finance (Ministério da Fazenda) and its newly instituted subsidiary the Secretaria de Prêmios e Apostas which authorises and monitors sports betting and online casinos in accordance with Brazil’s new online gambling legislation.

Placing big bets on Latin America?

Read our market-by-market report on opportunities and player onboarding.