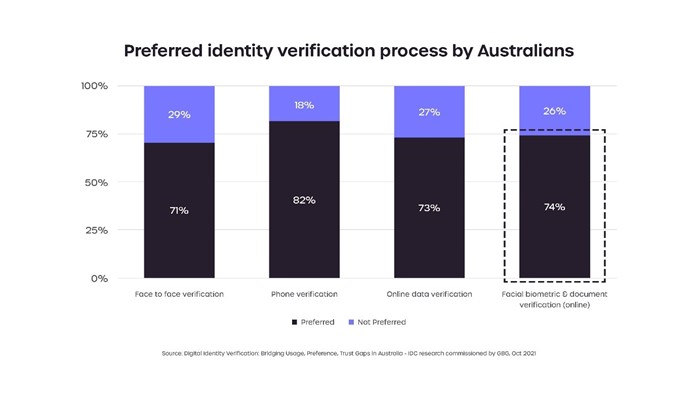

3 in 4 Australians prefer using facial biometric verification for verification of identity

SYDNEY, AUSTRALIA. 16 November 2021: GBG (AIM:GBG), the global experts in digital identity, helping businesses prevent fraud and meet complex compliance requirements, has today released findings from its “Digital Identity Verification: Bridging Usage, Preference, Trust Gaps in Australia” market research conducted by IDC. The IDC research, commissioned by GBG, finds that Australian consumers want to use biometric technology and have high expectations of its capabilities, pegging it as the most efficient identity verification methodology with added benefits of identity fraud prevention.

Consumers are driving demand for biometrics

The survey of 1,502 Australian consumers found 13% of consumers have experienced online facial biometric and document validation and close to 3 in 10 consumers have utilised this verification methodology when accessing fintech/payments services. Lining up the types of digital activities consumers are using today and thinking of using more in the future, facial verification (28%) came up among the top three, just behind digital fingerprinting verification (34%) and Buy Now Pay Later (BNPL) services (33%). Younger generations are more open to these digitised types of identity verification, with 18-44 year olds being three times more likely to have used facial biometric and document validation than 45+ year olds.

Australians believe that facial biometric verification with document validation requires the shortest amount of time to complete a submission. 95% of consumers expect face-to-face verification at the branch to take between 5-30 minutes and 94% expect the same lengthy process for phone verification. On the other hand, 71% of Australians believe online verification requiring manual data entry would take under five minutes to complete. 79% of Australians believe the same for facial biometric and documentation verification, out of which one quarter expects facial biometric and documentation verification to take under one minute to complete.

Michael Araneta, AVP for IDC Financial Insights and lead analyst for the survey remarks, “Across different age groups and other demographics, there are differences in terms of customer preferences for identity verification and fraud mitigation. The younger segments, as expected, are more inclined to take on newer technologies in identity verification, and will likely prefer those new solutions over others once trust and convenience is established. Ultimately, customers will be sticky to the solutions that they trust. Australian businesses supporting increasingly digital customers must ensure getting the mix of trust, convenience, and experience right.”

With the rise of fraud and scams, facial biometric verification is also seen to be more secure as facial properties are more difficult to “steal” (40%), and this technology can avert the risk of scams (39%). This is where passive liveness technology can be leveraged by financial institutions to enable faster and easier onboarding experiences for consumers, while also preventing deepfakes, spoofing, and cases of stolen identity. Some other factors that have driven preference for biometric verification include it being seen as modern (52%) and cool (35%).

However, despite this growing preference for facial biometrics, 61% of consumers believe face-to-face verification is the most trustworthy method, followed far behind by online data verification (17%).

Carol Chris, Regional General Manager of Australia and New Zealand, GBG, commented, “In the last 12 months, two-thirds of Australians had created up to six new online accounts. Australians want faster, easier and more secure ways to verify their identity as they increase their volume of online activities, be it digital banking, online shopping and grocery purchases, or accessing digital government services. The shift to online verification of identity will continue to accelerate and, though facial biometric verification and online document validation are not regulated requirements today, organisations need to consider that changes in consumer behaviour and expectations are demanding these capabilities.”

Chris added, “There is a gap in trust for biometric verification. Consumers are naturally hesitant with services they are less familiar with or have not experienced. More education on the security of digital identity verification and how data is used would lead to 58% of consumers increasing their acceptance and use of online and biometric verification. This presents an opportunity for enterprises, technology providers like GBG, and the government to collaborate to help consumers gain confidence.”

Australians want businesses to act fast when fraud occurs

Australians feel most vulnerable to stolen ID/identity theft (42.4%), scams (39.7%), malware (38.9%), and ransomware (35.1%). More than 1 in 3 (38%) take responsibility for protecting themselves from fraud, almost 1 in 3 (27%) also assign responsibility to the most trusted institutions, such as governments and banks. And 1 in 10 place attribute this to the merchant (11%) and the payment gateway (9%).

In the case of fraud, 73.2% expect a 100% refund, and more than half expect resetting and restoring of the account with minimal delay (56.9%), an instant text alert via mobile (54.2%), and a call via mobile (50.9%). The research reflects strong expectations among consumers to be protected by consumers, while businesses are also addressing their moral obligation to assist consumers under threat.

GBG hosted a webinar “Digital Identity Verification that both Customers and Businesses Trust” on 11 November, 11-12pm AEDT, where IDC presented the findings of the research.

To watch the webinar on-demand, please click here.

To find out more about greenID, a GBG end-to-end digital and facial biometric identity verification solution, please visit: www.gbg-greenid.com

About GBG: GBG (AIM: GBG) offers a range of solutions that help organisations quickly validate and verify the identity and location of their customers. Our market-leading technology, data and expertise help our customers improve digital access, deliver a seamless experience and establish trust so that they can transact quickly, safely and securely with their customers online. Headquartered in the UK and with over 1,000 team members across 16 countries, we work with 20,000 customers in over 70 countries. Some of the world’s best-known businesses rely on GBG to provide digital services and keep the economy moving, from US e-commerce giants to Asia's biggest banks and European household brands. To find out more about how we help our clients establish trust with their customers, visit www.gbgplc.com/apac, follow us on Twitter @gbgplc or LinkedIn.

- Press releases