Award-winning fraud risk management solution

Enabling Asia's banks access to the unbanked population

72% of Financial Institutions (FIs) in Indonesia are focusing on the country’s 181 million Unbanked segment, in 2021

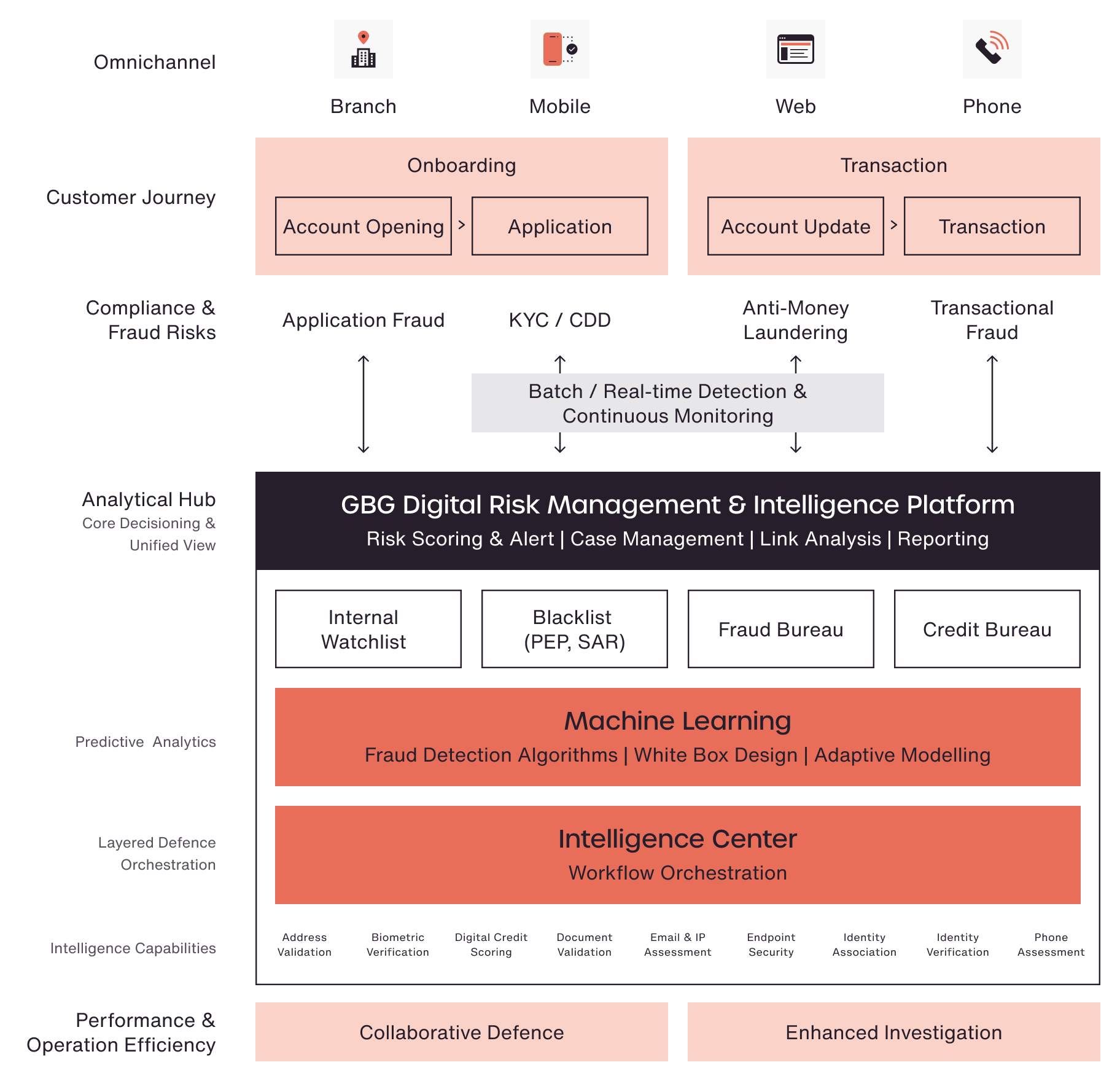

The new-to-bank and new-to-credit segments run the risk of submitting insufficient and unreliable data, making it difficult or impossible to process their banking and credit applications. GBG’s Digital Risk Management and Intelligence platform is designed to help FIs manage the lack of deterministic data to confidently onboard these consumers while protecting the FI.

Acquire more unbanked customers

Securely leverage mobile metadata with analysis of 50,000 data points and 320 smartphone behavioral characteristics to onboard legitimate new-to-bank and new-to-credit customers

Increase credit & fraud risk protection by up to 40%

Combining alternative credit risk scoring and digital fraud management technology to perform credit risk and fraud check to effectively process banking and credit applications from applicants with insufficient data

Reduce first party fraud risk

More than 53% of Indonesian Financial Institutions see bank fraud like scam, muling, fake ID and stolen identity fraud increasing in 2021. Protect against bad actors using the Unbanked to commit fraud

Trusted by BUKU 4

We currently work with five of the BUKU 4 banks in Indonesia. Through out 15 years experience in Indonesia, we have been able to establish a string understanding of local regulations and network with local Financial Institutes and regulation bodies, to help protect our customer from fraud.

Application Fraud Instinct Hub

Our award-winning end-to-end fraud and AML compliance risk management solution helps efficiently onboard new customers at the application stage.

Intelligence Centre

Our Intelligence Centre is deployed by state-owned BUKU 4 banks to achieve 85% efficiency when onboarding customers. The platform has on-demand access to 9 in-built capabilities analysing IP, mobile, device, email, location and social footprint for enhanced fraud detection and prevention.

Fraud prevention solutions with GBG Digital Risk Management and Digital Platform

Trusted by over 20,000 companies